About the company

We improve the lives of our customers with innovative offers and services.

Company Portrait

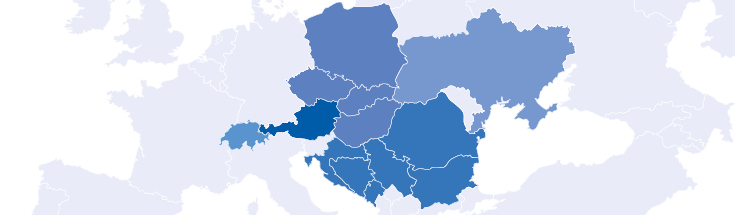

The UNIQA Group is one of the leading insurance companies for private and corporate customers in its core markets of Austria and Central and Eastern Europe (CEE). Over 20,000 employees and exclusive sales partners in 14 countries support more than 17 million customers.

Our services

We want to improve the lives of our customers as reliable companions and as inspiring coaches with innovative offers and services that are relevant every day.

Company key figures

The UNIQA Group has a balanced portfolio in the core markets of Austria and CEE.

Our management

The UNIQA Insurance Group AG was established in 1999. It is the parent company of the UNIQA Group and acts as the central reinsurer. UNIQA Insurance Group AG is listed on the Vienna Stock Exchange.

Our history

The UNIQA Insurance Group can look back on a history of more than 200 years. In 1811 the Salzburger Landes-Versicherung was founded.

Our strategy

The future programme “UNIQA 3.0 – Seeding the Future” is the positive response to the many challenges facing society, the economy and people today.

Our mission statement

People have insured themselves with us since 1811. Our mission has remained unchanged ever since then: Risks that the individual cannot carry alone are spread across the shoulders of the community.

UNIQA 3.0

We must and want to be more than just an insurance company. Our vision is to become the best service provider for safety, health and prevention in people's lives.

UNIQA in Europe

In Austria, UNIQA is the second-largest insurance group with a market share of around 21 percent. In the growing CEE region, UNIQA is represented in 11 markets. In addition, insurance companies in Switzerland and Liechtenstein are part of the UNIQA Group.

Visit our company blog

Gender diversity: Through the lens of our leaders

Read interview

Together for the climate: Now more than ever!

Read article

NatCat Competence Center - unique in CEE

Read interview